A choice of solutions to meet your Tax Digital needs

Businesses above the VAT threshold have been mandated to keep their records digitally and submit their VAT returns to the HMRC directly through the HMRC MTD API. VAT-registered businesses with a taxable turnover below £85,000 are required to follow Making Tax Digital rules for their first return starting on or after April 2022.

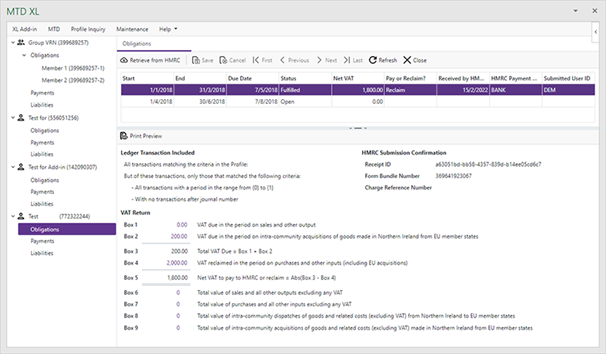

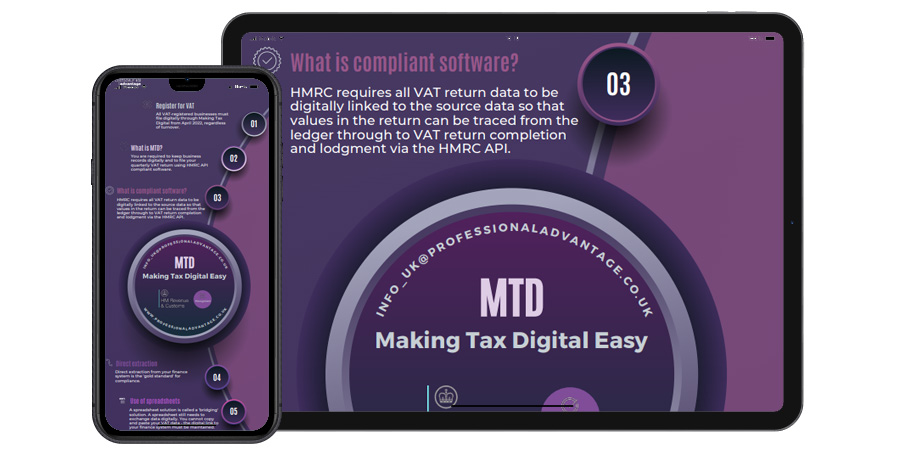

HMRC’s requirement is that all VAT return data is digitally linked to the source data so that values in the return can be traced from the ledger (i.e. purchase/sales ledger) through to VAT return completion and upload. This ensures that your records are accurate and up-to-date, making the entire process much smoother and easier for you.

Make sure you're up-to-date with the Making Tax Digital regulations and keep your business running smoothly with our MTD solution.

Are you tired of dealing with the stress and hassle of calculating your VAT return manually?

Our MTD solution will make calculating your VAT return easier and fully auditable. As HMRC recognised software, it meets the HMRC requirement for security and digital submission of returns, while also offering real time inquiry and visibility of information held by the HMRC.

Our solution is not only HMRC recognised, but it also makes calculating your VAT return easier and fully auditable. With real-time inquiry and visibility of information held by HMRC, you can rest assured that your data is accurate and up-to-date. And with support for an unlimited number of VAT numbers and groups, our solution is perfect for businesses of any size.

We understand that tax management can be complex, which is why our solution goes beyond basic HMRC submission requirements. It offers strong core features that improve the efficiency of your tax return process, including support for partially recoverable tax and source transactions recorded in other systems.

MTD Making Tax Digital Easy

What sets us apart

MTD from Professional Advantage has a proven track record of successful tax submissions. We have been meeting the needs of a wide, mature client base for over 20 years. It is the most widely used MTD solution amongst the Infor SunSystems community in the UK.

You'll be happy to know that we are the only recognised Infor SunSystems global development house, with over 30 years of experience seamlessly integrating with your SunSystems data structure. With us, you have a choice of solutions that are both functionally rich and simple to use, adding value to your business every step of the way.

Don't let tax management bring you down. Choose our MTD solution and experience the ease and efficiency of a fully digital and auditable VAT return process.

MTD for Infor SunSystems

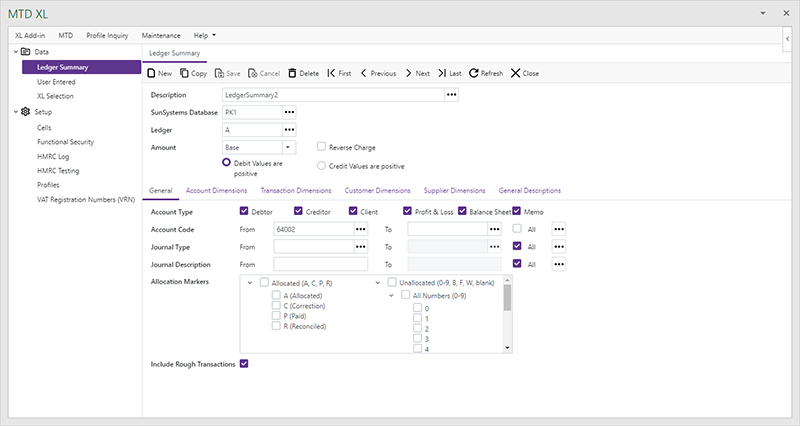

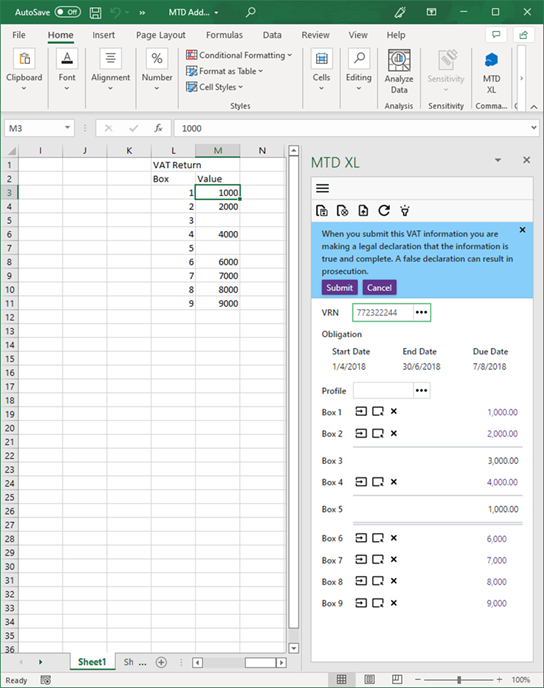

A system designed specifically for Infor SunSystems users, offering real time, flexible, direct extraction of VAT related values from your ledger. MTD maintains journal data integrity across returns and understands SunSystems data structures out of the box. It additionally provides an Excel ‘Add-In’, which allows you to include Excel based data in your return where needed.

MTD automates the link between Infor SunSystems and HMRC. The solution enables Infor SunSystems to export data to MTD avoiding the need to re-key data and the risk of errors. It also maintains the link between the data provided to HMRC and the source transactions. The key benefit of MTD, over Excel spreadsheets, is that it is fully auditable and eliminates costly errors.

Additionally, MTD allows returns to be submitted to the HMRC where the data source is exclusively in Excel spreadsheets hat enables MTD submission compliance where data has been extracted from the ledger in an HMRC recognised, digitally auditable fashion.

MTD has depth of functionality and the ability to address more complex MTD requirements, such as the inclusion of Partially Recoverable Tax calculation results from outside of Infor SunSystems and the ability to handle Group VAT.

Why people choose MTD from Professional Advantage

Making Tax digital solutions from Professional Advantage cater for all organisations, whether using Infor SunSystems as their financial solution or levering data from other finance systems or sources.

The key benefit of both our options, is that MTD is HMRC recognised, fully auditable and speeds up your VAT submission process.

Unlike other making tax digital offerings, our MTD solutions have a proven track record of successful tax submissions and has been shown to meet the needs of a wide, mature client base for over 20 years and are the most widely used making tax digital solutions amongst the SunSystems community in the UK.

Benefits

- Choice of Infor SunSystems solution or an Excel ‘Bridging’ function

- Electronic return passed into the secure HMRC API

- Allows for the storage of non VAT related information required to be reported on the Electronic Tax Return

- Electronic return passed into the secure HMRC API automatically and authenticated

- The process is automatic. A client could reduce the preparation, report running and record keeping time by 3 to 6 hours per reporting cycle thus reducing cost and errors

- Caters for multiple VAT Numbers and VAT Groups

- Allows for Transaction Date or Period based extraction

Benefits for Infor SunSystems sites

- Available on premise, private hosted or for Infor SunSystems Cloud (Excel Add In only currently)*

- Understands Infor SunSystems “out of the box”

- Compliance across Infor SunSystems 4.4, 5.4.1 and v6.1+

- Transfers Infor SunSystems data into the MTD VAT format

- Ability to include data held in Excel Spreadsheets in your return as a single source or in combination with SunSystems ledger data

- Electronic return passed into the secure HMRC API

- Provides an audit trail of previous VAT Returns and associated transactions

- Supports Infor SunSystems 4.4, 5.4.1 and v6.1 and above, inherently understanding SunSystems User Security, Business Units, and data structures - as with all Professional Advantage solutions

- Transfers Infor SunSystems data into the MTD VAT format

- Inclusion of links to complex spreadsheet calculation results and retention of this information, within the security of the SunSystems database as part of HMRC requirements.

Understands your data

Include external data

Period to month conversation

On demand inquiry, validation & submission

Full historical audit trail from your finance solution to HMRC

Caters for multiple Business units. databases and Groups

We can turn your vision into reality.

Complete the form below, or contact us on +44 (0)207 268 9800 to speak to one of our experts today.

Want to know more?

We understand that the software selection process takes time and research. MTD has helped many organisations like yours transform the way they do business.

Making Tax Digital Brochure

Making Tax Digital Infographic

On Demand Webinars